Crux appoints industry veteran, naggi asmar as CTO

I recently had the opportunity to interview Naggi Asmar, Crux’s new Chief Technology Officer, and I was excited to learn more about his journey, his...

2 min read

![]() Chris Handy

Jan 19, 2023

Chris Handy

Jan 19, 2023

Combining social and governance data provides a holistic quantitative and qualitative view of your investments.

In short, social data represents information on how companies socialize with their environment. That includes their employees, community, leadership, customers, and even LinkedIn followers. It also covers social issues, ranging from child labor law violations to employee DEI statistics and programs. In short, social is often what’s considered newsworthy and can sometimes be linked with governance data as well. Social data is often the most qualitative form of ESG data, and can be challenging to analyze.

Governance refers to order, rules, and regulations applied to a corporation. When it comes to governance data in the ESG space, it covers everything from individual governance at the micro level up to the laws and international operations adherence at the macro level. Just like environmental data, this large category of data is broken down and scored to help investors determine the level of risk associated with each corporation.

Governance can often be synonymous with decision-making for external data. Compared to its counterparts in ESG, governance is often the most-forgotten subsector of ESG data. Ironically, external data used for smarter decision-making doesn’t always include information on how decisions are made. Including governance data in your investment evaluations is critical because missteps can lead to scandals that bleed into environmental or social impacts.

Social and governance data are often intertwined and can sometimes be hard to separate at a glance. However, each still has its benefits when used for ESG analysis and decision-making.

Even though governance is not as popular as environmental or social data, it’s historically been around for longer than any other part of ESG data. It’s associated with evaluating an organization on things like board structure, compensation, codes of conduct, bribery, risk readiness, tax filings and reporting, and more. Depending on the vendor supplying the governance data, any combination of these criteria may be used and blended with additional factors like supply chain or historical financial data. When relying on governance data for investment decisions, companies must be completely aware of what data is being used to determine ratings and risk levels to maintain a holistic view of their investment choices.

Social data is grouped in with other information in datasets because it can be hard to verify. Since it’s a newer external reporting topic, most social data comes from management inside a company, which can result in questions about its authenticity. Social data is sometimes questioned about its true impact, as it doesn’t always have a direct material contribution to a company’s financial statements. However, including social data in your investment decisions gives the best view of a company’s true nature because it shows how they operate when a financial impact isn’t a consequence.

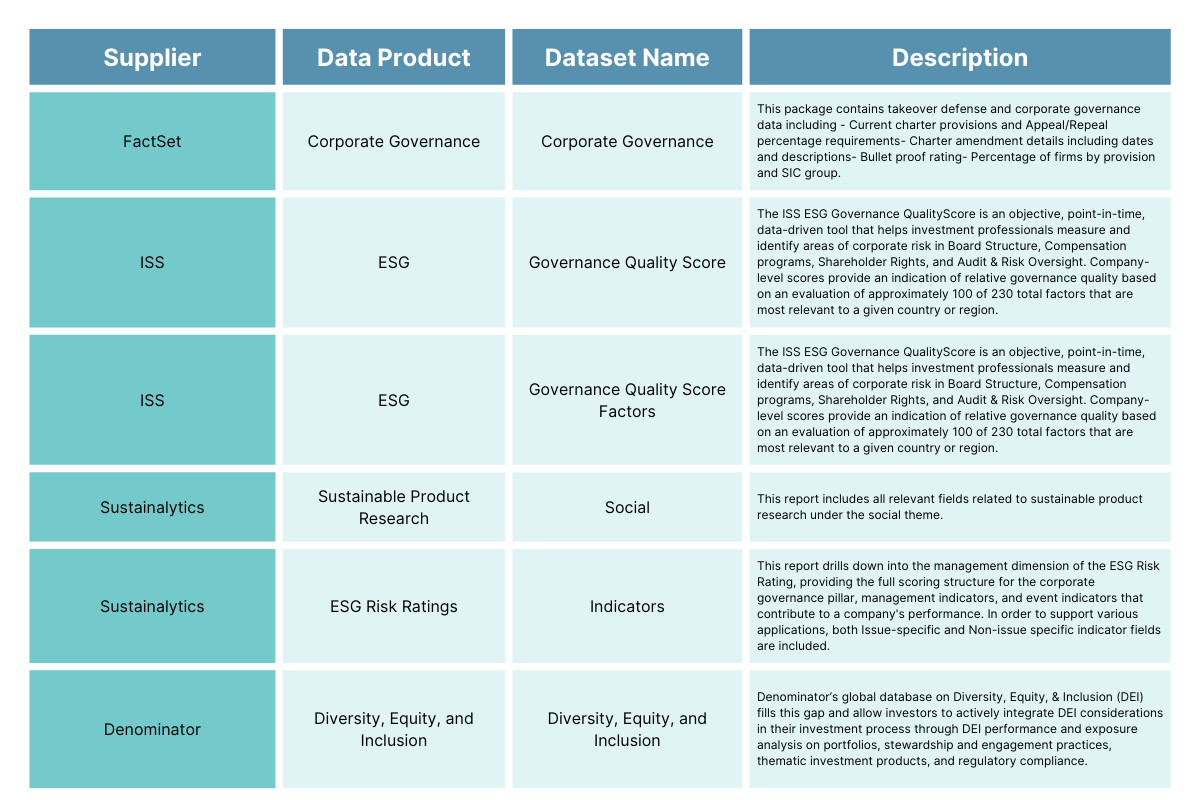

Social and governance data are a great place to start with ESG investing, as it creates a balance of old and new–qualitative and quantitative information. However, this can also be challenging, as navigating what data is accurate and reliable can quickly become a full-time job. We’ve curated a list of great datasets to get you started with social and governance data screening as you integrate ESG data into your analytical infrastructure. Note that these datasets come from a variety of external data suppliers. The table below highlights each dataset and supplier, as well as a brief description of what you can expect in each dataset.

If you’re ready to get started with ESG for external data integration into your organization, environmental data is a great place to start as it’s arguably the densest and most established piece of ESG data, due to the publicity and increasing focus on climate change.

With Crux, all datasets named in this starter pack are readily available within our platform and can be accessed within hours once you’re onboarded. And this is just the beginning–we have 50,000+ active pipelines, including more ESG starter packs, a huge variety of data vendors, specialized products, custom sources, web scrapes, and more.

If you’re interested in learning more about our other ESG data offerings or getting access to this starter pack, reach out to start the conversation today.

Chris Handy is the Director of Product Marketing at Crux. Chris joined Crux from Rasa, where he led product marketing initiatives and built out a Enablement and Voice of the Customer Programs. Chris has helped launched dozens of products in his career, and advises companies in early stages on product marketing as well.

I recently had the opportunity to interview Naggi Asmar, Crux’s new Chief Technology Officer, and I was excited to learn more about his journey, his...

As 2024 draws to a close, the Crux Data team has been reflecting on the key trends shaping 2025. #1 out of them all? Operational Alpha.

Not long ago, we observed here in our blog that the critical insights that drive business value come from data that is both (1) fast and (2) reliable.