Crux appoints industry veteran, naggi asmar as CTO

I recently had the opportunity to interview Naggi Asmar, Crux’s new Chief Technology Officer, and I was excited to learn more about his journey, his...

2 min read

![]() Chris Handy

Jan 6, 2023

Chris Handy

Jan 6, 2023

Controversies are a common filter for ESG data investments and a good place to start with external data investments.

As a refresher, ESG data stands for environmental, social, and governance data. It’s commonly used to evaluate the ethics of particular investments. It allows consumers to review various data points ranging from climate change impact to human rights to labor laws. This large subsector of data is usually broken down by letter and then scored overall to help investors determine the level of risk associated with each corporation.

ESG environmental data is most commonly associated with climate change or carbon emissions. However, it also can apply to water consumption, travel emissions, and employee contributions to global warming, and now, Scope 3 emissions that track climate factors through each level of your supply chain.

As carbon neutral and zero emissions pledges become the norm for corporations while global temperatures rise. Tracking who just commits versus actually completes their goals to help battle climate change helps investors eliminate riskier investments.

A common term in environmental pledging and investing is greenwashing, which happens when companies promise to make environmentally positive changes but don’t follow through. Before external ESG data became the norm, it was often just lip service or empty promises to create a better external view of a company. Now, environmental data can prove who is greenwashing and who is making positive changes for the world around us.

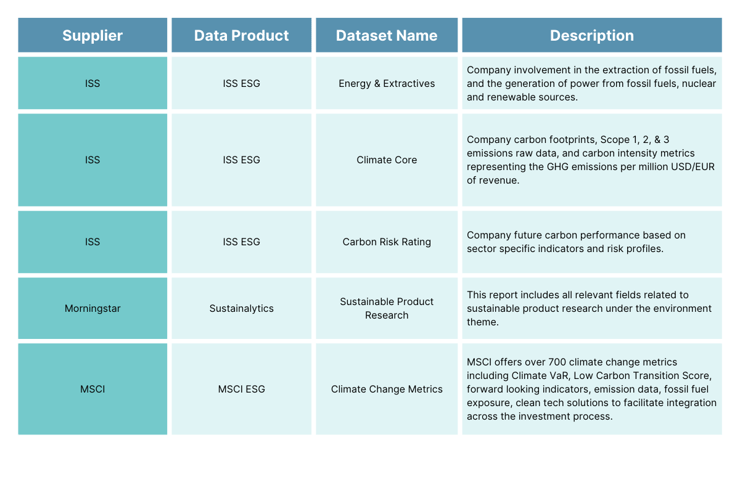

ESG environmental data is a great place to start with ESG investing, as the amount of data available is infinite. However, this can also be challenging, as navigating what data is accurate and reliable can quickly become a full-time job. We’ve curated a list of great datasets to get you started with controversies data screening as you integrate ESG data into your analytical infrastructure. Note that these datasets come from a variety of external data suppliers. The table below highlights each dataset and supplier, as well as a brief description of what you can expect in each dataset.

If you’re ready to get started with ESG for external data integration into your organization, environmental data is a great place to start as it’s arguably the densest and most established piece of ESG data, due to the publicity and increasing focus on climate change.

With Crux, all datasets named in this starter pack are readily available within our platform and can be accessed within hours once you’re onboarded. And this is just the beginning–we have 50,000+ data products available, including more ESG starter packs and a huge variety of data vendors, specialized products, and more.

If you’re interested in learning more about our other ESG data offerings or getting access to this starter pack, reach out to start the conversation today.

Chris Handy is the Director of Product Marketing at Crux. Chris joined Crux from Rasa, where he led product marketing initiatives and built out a Enablement and Voice of the Customer Programs. Chris has helped launched dozens of products in his career, and advises companies in early stages on product marketing as well.

I recently had the opportunity to interview Naggi Asmar, Crux’s new Chief Technology Officer, and I was excited to learn more about his journey, his...

As 2024 draws to a close, the Crux Data team has been reflecting on the key trends shaping 2025. #1 out of them all? Operational Alpha.

Not long ago, we observed here in our blog that the critical insights that drive business value come from data that is both (1) fast and (2) reliable.